Understanding how much are rental management fees is crucial for property owners. Rental property management costs can vary widely, depending on several factors such as the location, size of the property, and the services required. As a property owner in South Carolina, it’s essential to understand these costs to make informed decisions about your investments. In this comprehensive guide, we will explore the different factors that influence rental property management costs, answer the question of how much does property management cost, provide a breakdown of common fees, and offer tips for selecting the right property manager for your needs.

Factors Influencing Rental Property Management Costs

Location

The location of your rental property plays a significant role in determining property management fees. Properties in urban areas with higher population densities and market demand may have higher property management costs than those in rural areas. Additionally, the cost of living in a specific region can impact management fees, as companies need to cover their operational expenses.

Urban vs. Rural Areas

Property management fees are generally higher in urban areas than in rural regions. This is primarily due to the higher demand for rental properties and a more competitive market in urban settings. However, properties in rural areas may require additional services or more extensive maintenance, which can also impact property management costs.

Market Demand Areas

With strong rental markets and high demand for rental properties often have higher property management costs. This is because property management companies are busier and can charge more for their services. In contrast, areas with lower rental demand may see lower management fees.

Cost of Living

The cost of living in a region directly influences property management costs. In areas with a higher cost of living, property management companies may charge more to cover their expenses, such as wages, rent, and utilities.

Property Size

The size of your rental property is another essential factor that affects management costs. Larger properties or those with multiple units typically require more time and effort to manage, leading to higher fees.

Number of Units

Properties with multiple rental units often have higher management fees. This is because managing multiple tenants and addressing their needs requires more time and resources.

Square Footage

Larger properties, in terms of square footage, may also incur higher management fees. More extensive properties usually require more maintenance and upkeep, resulting in higher costs.

Services Required

The specific property management services you require from a property manager will directly impact the fees you pay. Some common services include tenant screening and placement, rent collection, maintenance and repairs, and legal and accounting support. Each of these services may be billed separately or bundled into a single management fee.

Tenant Screening and Placement

A property management company typically offers tenant screening and placement services to ensure the right tenants occupy your property. These services may include background checks, credit checks, and verifying references. The fees for these services can vary depending on the level of detail and the resources required.

Rent Collection

Rent collection is a standard service offered by property management companies. This service ensures timely rent payments and can help to address any late or missed payments. Fees for rent collection are often included in the overall management fee but may also be billed separately.

Maintenance and Repairs

Property management companies usually handle maintenance and repair tasks for your rental property. This can include routine maintenance, such as landscaping and pest control, and emergency repairs for plumbing or electrical problems. The fees for these services can vary depending on the extent of the work required and whether the company uses in-house staff or contracts out the work to third-party vendors.

Legal and Accounting Support

Property management companies may also provide legal and accounting support, such as assisting with lease agreements, handling eviction processes, and managing financial records. These services can be valuable for property owners but may also incur additional fees.

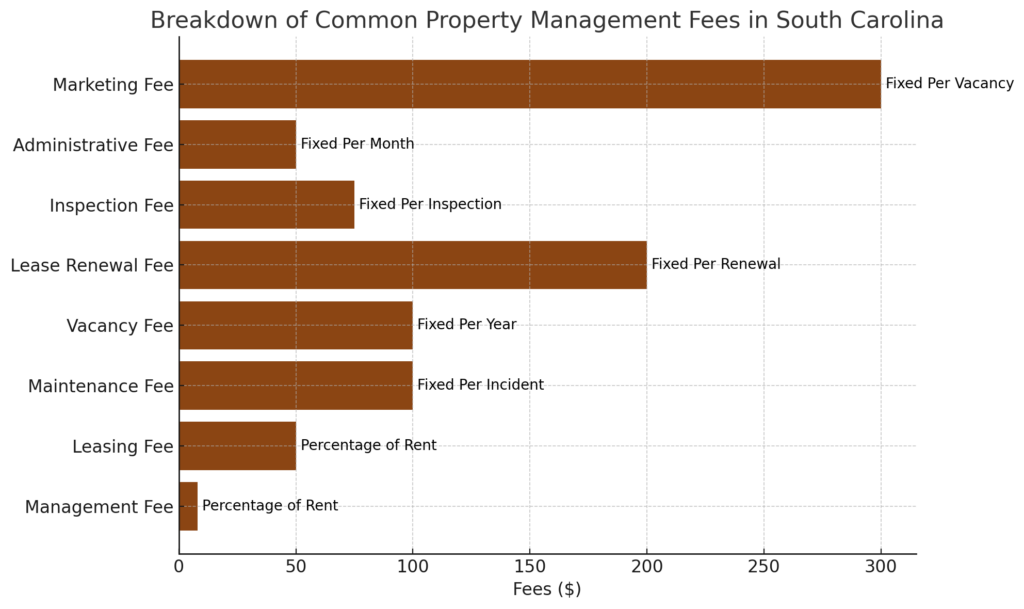

Breakdown of Common Property Management Fees

Management Fee

The management fee is the primary cost associated with hiring a property management company. This fee is typically a percentage of the monthly rent collected, ranging from 8% to 12%. Some companies may also charge a flat fee instead of a percentage.

Tenant Placement Fee

A tenant placement fee covers the cost of finding and screening prospective tenants. This fee can range from 50% to 100% of one month’s rent, depending on the company and the level of service provided.

Maintenance and Repair Fees

Maintenance and repair fees vary widely, depending on the tasks required and whether the property management company uses in-house staff or contracts the work to third-party vendors. These fees may be billed separately or included in the overall management fee.

Lease Renewal

Fee A lease renewal fee may be charged when a tenant renews their lease for another term. This fee typically ranges from $100 to $300 and covers the cost of updating the lease agreement and ensuring all legal requirements are met.

Late Payment Fee

If a tenant pays their rent late, the property management company may charge a late payment fee. This fee is typically a percentage of the rent or a flat fee and is often shared between the property management company and the property owner.

Common Hidden Fees

Vacancy Fees

Fees charged when a property is vacant, which can include costs for advertising, inspections, and maintaining the property during vacancy.

Mitigation Strategy: Negotiate with the property management company to minimize or waive vacancy fees.

Eviction Fees

Costs associated with the eviction process, including legal fees, court costs, and locksmith fees.

Mitigation Strategy: Understand the company’s eviction process and fees upfront to avoid surprises.

Administrative Fees

Charges for administrative tasks such as paperwork, filing, and tenant communications.

Mitigation Strategy: Request a detailed list of administrative tasks and associated costs.

Maintenance Markups

Extra charges added to the cost of maintenance and repair services.

Mitigation Strategy: Ask if the company marks up maintenance costs and, if so, by how much. Negotiate lower or no markups.

Renewal Fees

Fees charged for renewing a tenant’s lease agreement.

Mitigation Strategy: Include renewal fees in your initial negotiations with the property management company.

Emergency and Routine Maintenance

Maintaining rental properties involves handling both routine and emergency maintenance tasks to ensure the property remains in good condition and tenants are satisfied. Understanding the costs associated with these maintenance tasks is crucial for property owners to manage their investments effectively.

Cost of Maintenance

Routine Maintenance: Routine maintenance refers to regular, ongoing tasks required to keep the property in good condition. These tasks are often scheduled and can be budgeted for in advance. Common routine maintenance tasks include:

- Landscaping and Lawn Care: Regular mowing, trimming, and upkeep of the property’s exterior. Costs typically range from $50 to $200 per month, depending on the property’s size and complexity.

- Pest Control: Regular pest inspections and treatments to prevent infestations. This can cost between $30 to $50 per month.

- HVAC System Maintenance: Annual or bi-annual inspections and servicing of heating, ventilation, and air conditioning systems. These services usually cost between $100 and $300 per visit.

- Plumbing Inspections: Regular checks of plumbing systems to identify and address minor issues before they become major problems. Costs can range from $75 to $150 per inspection.

- General Repairs: Minor repairs such as fixing leaky faucets, replacing light bulbs, and addressing minor wear and tear. The costs for these tasks can vary but typically range from $50 to $150 per month.

Emergency Maintenance: Emergency maintenance involves unexpected repairs that require immediate attention to prevent further damage or address urgent tenant needs. These tasks can be unpredictable and often come with higher costs due to the urgency and complexity involved. Common emergency maintenance tasks include:

- Plumbing Emergencies: Burst pipes, severe leaks, or clogged drains requiring immediate repair. Emergency plumbing services can cost between $150 to $500 or more, depending on the severity of the issue.

- Electrical Problems: Power outages, faulty wiring, or other electrical issues that pose safety risks. Emergency electrical repairs typically range from $100 to $400 or more.

- HVAC Failures: Sudden breakdowns of heating or cooling systems, especially during extreme weather conditions. Emergency HVAC repairs can cost between $150 to $600 or more.

- Roof Leaks: Severe leaks or damage to the roof requiring immediate repair to prevent water damage. Emergency roof repairs can range from $200 to $1,000 or more, depending on the extent of the damage.

- Locksmith Services: Issues such as lockouts or broken locks that require immediate attention. Emergency locksmith services usually cost between $100 to $300.

Cost of Preventive Maintenance

Implementing preventive maintenance plans can help property owners manage costs more effectively by addressing potential issues before they become major problems. These plans involve regular inspections and proactive maintenance tasks designed to extend the lifespan of property systems and reduce the likelihood of emergency repairs.

Preventive maintenance plans typically involve a combination of scheduled inspections and routine maintenance tasks. Property management companies may offer these plans as part of their services, with costs ranging from $300 to $600 per year, depending on the property’s size and complexity.

Examples of Preventive Maintenance Tasks:

- Seasonal HVAC Inspections: Ensuring heating and cooling systems are functioning optimally before peak usage periods.

- Roof Inspections: Regularly checking the roof for signs of wear or damage to prevent leaks and water damage.

- Appliance Maintenance: Cleaning and servicing appliances such as refrigerators, ovens, and washing machines to extend their lifespan and improve efficiency.

- Exterior Inspections: Checking the property’s exterior for signs of damage or deterioration, including siding, windows, and doors.

- Safety Checks: Regularly testing smoke detectors, carbon monoxide detectors, and fire extinguishers to ensure they are in working order.

By understanding the costs and benefits of both emergency and routine maintenance, property owners can make informed decisions about managing their rental properties and ensuring tenant satisfaction.

Tips for Selecting the Right Property Management Company

Research Potential Companies

Before choosing a property management company, conduct thorough research on potential candidates. Read online reviews, ask for recommendations from other property owners, and consult with local real estate agents.

Compare Fees and Services

Make sure to compare the fees and services offered by different property management companies. Look for a company that provides the specific services you need at a competitive price.

Interview Potential Candidates

Interview several property management companies to get a feel for their communication style, professionalism, and experience. This will help you find a company that you can trust and work well with.

Check References and Credentials

Before signing a property management contract, check the references and credentials of the property managers. Verify that they have the necessary licenses, certifications, and insurance coverage to operate in your area.

Understanding rental property management costs in South Carolina is crucial for making informed decisions about your investment properties. Factors such as location, property size, and the services required can significantly impact these costs. By carefully considering these factors, comparing fees and services, and selecting the right property management company, you can effectively manage your rental properties and maximize your return on investment.

Ray Covington Property Management is a leading property management company serving various cities in South Carolina, including Columbia, Lexington, Irmo, Chapin, Lake Murray, West Columbia, Blythewood, and Fort Jackson. With years of experience, our professional team offers comprehensive services, including tenant screening, rent collection, maintenance and repairs, and legal and accounting support. Trust Ray Covington Property Management to expertly manage your rental properties, providing peace of mind and allowing you to focus on growing your investments. Contact Us Today!

More Resources

National Association of Residential Property Managers (NARPM)